文件目录:财会考证:2021FRM,文件大小:49.86G

2021FRM二级高[24.51G]

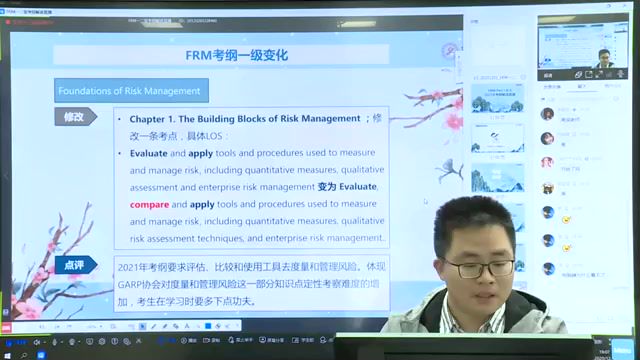

00-21年考纲解读[122.15M]

20201202_FRM一二级考纲解读直播.pdf[2.32M]

2021年FRM考纲解读直播.mp4[119.83M]

01-前导班[216.81M]

01-风险管理基础[42.56M]

01-ModernPortoflioTheory.mp4[13.69M]

02-CapitalAssetPricingModel.mp4[15.65M]

03-TheArbitragePricingTheory.mp4[13.23M]

02-定量分析[46.65M]

01-BasicConceptsofProbaility.mp4[11.88M]

02-Distributions.mp4[12.15M]

03-Hypothesistesting.mp4[11.95M]

04-ReturnVolatilityandcorrelation.mp4[10.67M]

03-金融市场与产品[61.72M]

01-BinomialTrees.mp4[24.92M]

02-Black-Scholes-MertonModel.mp4[11.95M]

03-FundManagement.mp4[14.39M]

04-Centralcounterparties.mp4[10.46M]

04-估值与风险模型[61.22M]

01-01-Interestrates.mp4[18.60M]

02-Duration.mp4[8.18M]

03-Marketrisk.mp4[12.92M]

04-Creditrisk.mp4[10.96M]

05-Operationrisk.mp4[10.57M]

P2前导-P1B2.pdf[1.03M]

P2前导-P1B3.pdf[1.01M]

P2前导-P1B4.pdf[1.62M]

P2前导课(针对投资风险).pdf[1.00M]

02-知识精讲[13.16G]

01-投资管理与风险管理[1.69G]

01-IntroductionofRiskManagemengandInvestmengManagement.mp4[38.25M]

02-FactortheoryandCAPM.mp4[149.76M]

03-MultifactorandEMH.mp4[74.25M]

04.mp4[105.04M]

05.mp4[150.83M]

06.mp4[47.21M]

07.mp4[132.86M]

08.mp4[54.32M]

09.mp4[140.55M]

10.mp4[50.80M]

11.mp4[107.05M]

12.mp4[128.70M]

13.mp4[43.69M]

14.mp4[38.60M]

15.mp4[129.81M]

16.mp4[40.98M]

17.mp4[52.43M]

18.mp4[48.82M]

19.mp4[86.12M]

20.mp4[34.75M]

21.mp4[71.12M]

02-市场风险管理与测量[2.24G]

01.mp4[69.72M]

02.mp4[97.12M]

03.mp4[85.49M]

04.mp4[27.56M]

05.mp4[135.79M]

06.mp4[75.20M]

07.mp4[94.00M]

08.mp4[114.07M]

09.mp4[131.35M]

10.mp4[55.46M]

11.mp4[84.29M]

12.mp4[60.22M]

13.mp4[112.43M]

14.mp4[71.09M]

15.mp4[60.34M]

16.mp4[61.82M]

17.mp4[187.95M]

18.mp4[29.89M]

19.mp4[133.20M]

20.mp4[128.02M]

21.mp4[91.23M]

22.mp4[77.67M]

23.mp4[107.72M]

24.mp4[2.45M]

25.mp4[71.91M]

26.mp4[124.15M]

03-操作风险与综合风险[2.58G]

01-IntroductionofOperationalRiskResiliencyWeight.mp4[25.74M]

02-PrinciplesfortheSoundManagementofOperationalRisk(1).mp4[116.03M]

03-PrinciplesfortheSoundManagementofOperationalRisk(2).mp4[100.22M]

04-WhatisERM.mp4[50.46M]

05-BankingConductandCulture(1).mp4[38.71M]

06-BankingConductandCulture(2).mp4[32.19M]

07-RiskCulture.mp4[48.71M]

08-EnterpriseRiskManagementTheoryandPractice.mp4[61.78M]

09-ImplementingRobustRiskAppetiteFramaworkstoStrengthenFinancialInstiutions.mp4[88.19M]

10-OpRiskDataandGocernance(1).mp4[45.14M]

11-OpRiskDataandGocernance(2).mp4[115.34M]

12-InformationRiskandDateQualityManagement.mp4[51.72M]

13-SupervisoryGuidanceonModelRiskManagement.mp4[92.68M]

14-VolidatingRatingModels.mp4[79.81M]

15-AssessingtheQualityofRiskMeasures.mp4[56.14M]

16-RiskCapitalAttributionandRisk-adjustedPerformanceMeasurement.mp4[132.28M]

17-RangeofPracticesandissuesinEconomicCapitaiFrameworks.mp4[99.12M]

18-CapitalPlanningatLargeBankHoldingCompanies.mp4[39.11M]

19-StressTestingBanks.mp4[37.43M]

20-RegulationoftheOTCDerivatiesMarket.mp4[140.32M]

21-CapitalRegulationBeforetheGlobalFinancialCrisis(1).mp4[192.49M]

22-CapitalRegulationBeforetheGlobalFinancialCrisis(2).mp4[234.84M]

23-Solvency,LiquidityandOtherRegulationAftertheGlobalFinancialCrisis.mp4[184.64M]

24-High-levelSummaryofBasel3Reform(1).mp4[55.48M]

25-High-levelSummaryofBasel3Reform(2).mp4[50.55M]

26-Basel3FinalisingPost-CrisisReforms.mp4[89.48M]

27-Supplementary.mp4[72.89M]

28-GuidanceonManagingOutsourcingRisk.mp4[48.67M]

29-ManagementofRisksAssociatedwithMoneyLaunderingandFinancingofTerrorism.mp4[17.26M]

30-TheCyber-ResilientOrganization.mp4[75.27M]

31-Cyber-resilienceRangeofpractices.mp4[117.73M]

32-BulldingtheUKFinancialSectorsOperatianalResilience.mp4[23.50M]

33-StrivingforOperationalResilience.mp4[31.49M]

04-流动性与资金风险测量与管理[1.95G]

01-IntroductionofLiquidityandTreasuryRiskMeasurementandManagement.mp4[79.80M]

02-liquidityrisk.mp4[166.98M]

03-liquidityandlecerage(1).mp4[102.74M]

04-liquidityandlecerage(2).mp4[78.96M]

05-liquidityTransferPricing.mp4[78.12M]

06-TheFailureofDealerBank.mp4[42.41M]

07-CoveredInterestRatePariteLost.mp4[88.01M]

08-TheshortageofUSdollar.mp4[31.55M]

09-TheinvestmentFunctionofFinancialServicesManagement.mp4[167.66M]

10-RepurchaseAgreementsandFinancing.mp4[138.77M]

11-illiquidAssets.mp4[121.61M]

12-LiquidityandReservesManagementStrategiesandPolices.mp4[148.25M]

13-ManagingandPricingDepositServices.mp4[118.47M]

14-ManagingNon-depositLiabilities.mp4[118.87M]

15-RiskManagementforChanginginterestRate.mp4[146.48M]

16-LiquidityStressTesting.mp4[66.38M]

17-LiquidityRiskReportingandStressTesting.mp4[46.17M]

18-IntradayLiquidityRiskManagement.mp4[69.95M]

19-MonitoringLiquidity.mp4[114.47M]

20-Earlywarningindicators.mp4[32.05M]

21-ContingencyFundingPlanning.mp4[34.37M]

05-估值风险管理与测量[3.15G]

01-IntroductionofCreditRiskMeasurementandManagement.mp4[55.65M]

02-Session0前情提要.mp4[26.33M]

03-componensofcreditrisk.mp4[73.42M]

04-creditanalysis.mp4[66.68M]

05-TheCreditAnalyst.mp4[59.99M]

06-DefineltionRelatedtoPD.mp4[91.35M]

07-CreditRatings.mp4[108.88M]

08-MertonModel(1).mp4[90.12M]

09-MertonModel(2).mp4[112.50M]

10-KMVModel.mp4[47.86M]

11-DefaultInyensityModels.mp4[79.42M]

12-SpreadandHazardRate(1).mp4[87.14M]

13-SpreadandHazardRate(2).mp4[62.24M]

14-RetailCreditRisk.mp4[64.07M]

15-CreditScoring.mp4[95.57M]

16-Statistical-basedModels(1).mp4[76.41M]

17-16-Statistical-basedModels(2).mp4[61.03M]

18-HeuristicandNumercalApproaches.mp4[52.59M]

19-MetricsforCreditExposure.mp4[53.07M]

20-Exposureprofileofvarioussecuritise.mp4[81.46M]

21-unexpectedloss.mp4[76.58M]

22-creditvardefaultcorrelation.mp4[123.49M]

23-creditriskportfoliomodels.mp4[77.77M]

24-singlefactormodel.mp4[75.12M]

25-BasicsofCounterpartyRisk.mp4[55.06M]

26-Wrong-wayRiskandRight-wayRisk.mp4[89.31M]

27-Netting,close-out(1).mp4[108.81M]

28-Netting,close-out(2).mp4[62.32M]

29-Margin(collateral)(1).mp4[114.81M]

30-Margin(collateral)(2).mp4[99.25M]

31-CreditValuationAdjustmentandxVA.mp4[63.85M]

32-CVApricingandallocation(1).mp4[63.59M]

33-CVApricingandallocation(2).mp4[111.11M]

34-StressTestforCounterpartyExposures.mp4[36.12M]

35-CreditDefaultSwap.mp4[85.22M]

36-OtherCreditDerivatives.mp4[85.27M]

37-TheprocessofSecuritization.mp4[72.75M]

38-Assetpools.mp4[74.92M]

39-Struturedproducts(1).mp4[71.53M]

40-Struturedproducts(2).mp4[69.34M]

41-CashflowsinSecuritizationStructure.mp4[87.64M]

42-SevenFritionsofSecuritizationProcess.mp4[66.73M]

43-课程总结.mp4[12.49M]

06-CurrentIssuesinFinancialMarkets[1.15G]

讲义[49.77M]

_WhenSellingBecomesViral.pdf[4.86M]

ArtificialIntelligenceandmanchinelearninginfinancialservices.pdf[9.75M]

ClimateChangePhysicalRiskandEquity,GlobalFinancialStabilityReport.pdf[4.54M]

CyberRiskandtheU.S.FinancialSystem_APre-MortemAnalysis.pdf[4.86M]

FinancialCrimeinTimesofCOVID-19-AMLandCyberResilienceMeasures.pdf[8.41M]

MachineLearning_ARevolutioninRiskManagementandCompliance.pdf[6.08M]

MarketsintheTimeofCovid-19.pdf[6.93M]

ThegreenswanCentralbankingandfinancialstabilityintheageofclimatechange.pdf[4.33M]

01-CyberRiskandtheUSFinancialSystemApre-mortemanalysis.mp4[183.76M]

02-MachineLearningARevolutioninRiskManagementandCompliance.mp4[116.29M]

03-ArtificialIntelligenceandmanchinelearninginfinancialservices.mp4[155.53M]

04-FinancialCrimeinTimesofCOVID-19-AMLandCyberResilienceMeasures.mp4[139.54M]

05-ClimateChangePhysicalRiskandEquityGlobalFinancialStabilityReport.mp4[130.02M]

06-ThegreenswanCentralbankingandfinancialstabilityintheageofclimatechange.mp4[180.36M]

07-WhenSellingBecomesViral.mp4[86.96M]

08-MarketsInTheTimeofCovid-19.mp4[138.26M]

讲义[417.00M]

FRMP2操作风险与弹性_2021(Mark老师).pdf[41.25M]

FRMP2流动性风险2021(GONG老师).pdf[27.84M]

FRMP2市场风险2021(DavidZhu).pdf[59.35M]

FRMP2网课投资风险2021(1)-(Gloria).pdf[55.58M]

FRMP2网课投资风险2021(2)-(Gloria).pdf[60.02M]

FRMP2网课投资风险2021(3)-(Gloria).pdf[63.39M]

FRMP2网课投资风险2021(4)-(Gloria).pdf[40.56M]

FRMP2网课信用风险2021(1)-(Gloria).pdf[23.64M]

FRMP2网课信用风险2021(2)-(Gloria).pdf[34.74M]

FRMP2网课信用风险2021session3-(Gloria).pdf[10.64M]

03-诺曼底复习[4.91G]

01-市场风险管理与测量[1.06G]

01-Introduction.mp4[15.15M]

02-AnIntroductionandOverview.mp4[64.54M]

03-Non-paramentricApproaches.mp4[42.30M]

04-ParametricApproachesExtremeValue.mp4[70.08M]

05-BacktestingVaR.mp4[69.07M]

06-VaRMapping.mp4[75.74M]

07-CorrelationBasicsDefinitions,Applications,andTerminology.mp4[43.74M]

08-EmpiricalPropertiesofCorrelationHowDoCorrelationsBehaveintheRealWorld.mp4[26.99M]

09-FinancialCorrelationModelingBottom-UpApproaches.mp4[33.37M]

10-TheScienceofTermStructureModels.mp4[115.12M]

11-TheEvolutionofShortRatesandtheShapeoftheTermStructure.mp4[75.42M]

12-TheArtofTermStructureModels:Drift.mp4[39.92M]

13-TheArtofTermStructureModels:VolatilityandDistribution.mp4[30.55M]

14-R01MessagesfromtheAcademicR02FundamentalReviewofTradingBook.mp4[73.18M]

15-EmpiricalApproachestoRiskMetricsandHedges.mp4[38.89M]

16-VolatilitySmiles.mp4[64.86M]

17-S1_VaR计量.mp4[43.67M]

18-S2_相关性建模.mp4[43.70M]

19-S3_利率模型.mp4[53.64M]

20-S4_其他篇章.mp4[35.00M]

FRM2021P2B1市场-复习串讲.pdf[26.20M]

FRM诺曼底强化题及解析-P2B1-市场风险.pdf[7.43M]

02-操作风险与综合风险[914.39M]

01-Session1:RiskManagementFramework.mp4[146.23M]

02-Session2:DataandModel.mp4[55.89M]

03-Session3:CapitalPlanning.mp4[43.36M]

04-Session4:BankFailure.mp4[12.74M]

05-Session5:Basel(1).mp4[56.28M]

06-Session5:Basel(2).mp4[111.06M]

07-Session5:Basel(3).mp4[86.14M]

08-Session5:Basel(4).mp4[97.63M]

09-Session6:NewTopics.mp4[77.85M]

10-强化班解析-1-15题.mp4[80.42M]

11-强化题解析16-30.mp4[85.41M]

12-强化题解析31-40题.mp4[44.55M]

FRMP2操作风险2021-复习串讲(MarkShao).rar[10.76M]

FRM诺曼底强化题及解析-P2B3-操作风险.pdf[6.07M]

03-流动性与资金测量与管理[862.71M]

01-IntroductionofLiquidityandTreasuryRiskMeasurementandManagement.mp4[11.62M]

02-Liquidityrisk.mp4[36.01M]

03-LiquidtyandLeverage.mp4[38.56M]

04-Liquidtytransfepricing.mp4[32.16M]

05-TheFailureofDealerBanks.mp4[13.15M]

06-CoveredInterestRateParityLost.mp4[32.69M]

07-TheUSdollarshortageinglobalbanking.mp4[12.47M]

08-TheInvestmentFunctioninFinancial-ServicesManagemeng.mp4[46.44M]

09-RepurchaseAgreementsandFinancing.mp4[44.05M]

10-illiquidAssets.mp4[42.29M]

11-liquidityandResevesManagement.mp4[49.11M]

12-Managingandpricingdepositservices.mp4[29.40M]

13-ManagingNondepositLiabilities.mp4[25.79M]

14-RiskManagementforChangingInterestRate.mp4[50.23M]

15-LiquidityStressTesting.mp4[34.53M]

16-LiquidityRiskReportingandStressTesting.mp4[23.30M]

17-IntradayLiquidityRiskManagement.mp4[21.36M]

18-MonitoringLiquidity.mp4[22.41M]

19-EarlWarningIndicators.mp4[16.89M]

20-contingencyfundingplanning.mp4[18.81M]

21-强化题解析1-10.mp4[51.58M]

22-强化题解析11-20.mp4[54.73M]

23-强化题解析21-30.mp4[38.53M]

24-强化题解析31-40.mp4[51.72M]

FRMP2流动性风险2021-复习串讲(GONG).rar[64.92M]

04-投资管理与风险管理[1.03G]

01-课程介绍.mp4[27.54M]

02-FactorTheory.mp4[76.88M]

03-Factors.mp4[42.34M]

04-Alpha(andtheLow-RiskAnomaly.mp4[94.89M]

05-PortfolioConstruction.mp4[101.77M]

06-PortfolioRiskAnalyticalMethods.mp4[92.42M]

07-VaRandRiskBudgetinginInvestmentManagement.mp4[78.69M]

08-RiskMonitingandPerformanceMesaurement.mp4[17.56M]

09-PortfolioPerformanceEvaluation.mp4[81.48M]

10-HedgeFunds.mp4[83.76M]

11-PerformingDuediligenceonSpecificManagersandFunds.mp4[13.24M]

12-强化题解析1-15.mp4[114.85M]

13-强化题解析16-30.mp4[114.12M]

14-强化题解析31-43.mp4[66.56M]

FRMP2投资风险2021-复习串讲(Gloria).rar[12.86M]

FRM诺曼底强化题及解析-P2B5投资管理.pdf[34.63M]

05-信用风险管理与测量[1.09G]

01-IntroductionofCreditRiskMeasurementandManagement.mp4[31.93M]

02-IdentificationofCreditRisk.mp4[61.62M]

03-Ratingassignmentmethodoligies.mp4[66.19M]

04-InferCreditRiskFromEquityPrices(1).mp4[71.94M]

05-InferCreditRiskFromEquityPrices(2).mp4[39.91M]

06-DefaultintensityModels.mp4[42.38M]

07-CreditScoringModel.mp4[38.54M]

08-OtherMethodstoEstimatePD.mp4[56.56M]

09-CreditExposure.mp4[62.12M]

10-ProtfolioCreditVaR.mp4[66.76M]

11-capitalforcreditrisk.mp4[64.76M]

12-Counterpartyriskandwrong-wayrisk.mp4[56.52M]

13-netting,close-outandmargin(1).mp4[37.51M]

14-netting,close-outandmargin(2).mp4[47.07M]

15-CVA(1).mp4[55.62M]

16-CVA(2).mp4[75.20M]

17-CreditDerivatives.mp4[78.27M]

18-SecuritizationandStructuredFinancialInstruments(1).mp4[74.94M]

19-SecuritizationandStructuredFinancialInstruments(2).mp4[58.06M]

20-FrictionsofSecuritization.mp4[25.45M]

04-重难点回顾[1.28G]

65题重难点回顾-估值与风险模型讲义.pdf[8.38M]

诺曼底复习开班.mp4[109.66M]

诺曼底复习开班直播.pdf[3.21M]

重难点题回顾-操作风险与综合风险.mp4[338.70M]

重难点题回顾-操作风险与综合风险讲义.pdf[10.37M]

重难点题回顾-流动性与资金风险测量与管理.mp4[162.83M]

重难点题回顾-市场风险管理与测量.mp4[291.69M]

重难点题回顾-市场风险管理与测量讲义.pdf[19.13M]

重难点题回顾-投资管理与风险管理.mp4[182.01M]

重难点题回顾-信用风险管理与测量.mp4[188.14M]

05-押题班[4.38G]

MOCK-A[1.15G]

MOCK-A操作风险与综合风险讲义.pdf[9.00M]

MOCK-A流动性与资金风险测量与管理.mp4[163.34M]

MOCK-A流动性与资金风险测量与管理讲义.pdf[6.03M]

MOCK-A市场风险管理与测量.mp4[325.62M]

MOCK-A市场风险管理与测量讲义.pdf[3.17M]

MOCK-A投资管理与风险管理讲义.pdf[19.18M]

MOCK-A信用风险管理与测量讲义.pdf[4.66M]

MOCK-A操作风险与综合风险.mp4[290.58M]

MOCK-A信用风险管理与测量.mp4[204.99M]

MOCK-A押题密卷投资管理与风险管理.mp4[148.02M]

金C模考班[3.24G]

模考二[1.69G]

FRM二级冲刺段模考二_Crystal_金程教育.pdf[0.99M]

FRM二级冲刺段模考二(答案)_Crystal_金程教育.pdf[357.43K]

FRM二级冲刺段模考二(题目)_Crystal_金程教育.pdf[661.03K]

FRM二级模考二1-19.mp4[478.09M]

FRM二级模考二20-26.mp4[116.22M]

FRM二级模考二27-42.ts[390.91M]

FRM二级模考二43-66.ts[435.32M]

FRM二级模考二67-80.ts[308.42M]

模考一[1.55G]

FRM二级冲刺段模考一_Galina_金程教育[1.33M]

FRM二级冲刺段模考一(答案)_Galina_金程教育.pdf[528.94K]

FRM二级冲刺段模考一(题目)_Galina_金程教育_.pdf[831.11K]

1.模考一01-17.ts[418.35M]

2.模考一18-25.mp4[86.60M]

3.模考一26-46.ts[381.32M]

4.模考一47-69.ts[439.13M]

5.模考一70-80.ts[257.09M]

金C押题卷[1.73M]

FRM二级冲刺段押题(答案)_Mikey_金程教育.pdf[597.17K]

FRM二级冲刺段押题(题目)_Mikey_金程教育.pdf[1.15M]

06-考前直播[172.14M]

考前直播.mp4[169.31M]

考前直播讲义.pdf[2.82M]

2021文档资料[277.14M]

2021年FRM二级Notes[23.25M]

FRM2021SchweserQuicksheetPartII.pdf[4.07M]

FRM2021SchweserNotesPartIIBook1.pdf[3.42M]

FRM2021SchweserNotesPartIIBook2.pdf[2.81M]

FRM2021SchweserNotesPartIIBook3.pdf[2.77M]

FRM2021SchweserNotesPartIIBook4.pdf[7.55M]

FRM2021SchweserNotesPartIIBook5.pdf[2.63M]

21年FRM二级教材[249.27M]

1.MarketRiskMeasurementandManagement.pdf[29.01M]

2.CreditRiskMeasurementandManagement.pdf[63.69M]

3.OperationalRiskandResiliency.pdf[65.35M]

4.LiquidityandTreasuryRiskMeasurementandManagement.pdf[57.76M]

5.RiskManagementandInvestmentManagement.pdf[33.47M]

2021年5月or7月选择考试时间及考点指引流程.pdf[375.67K]

21年FRM_StudyGuide.pdf[3.23M]

21年FRM_StudyGuideChanges.pdf[1.02M]

2021FRM一级高[25.34G]

00-2021年文档资料[117.05M]

21年FRM一级notes[19.23M]

Book1.pdf[3.50M]

Book2.pdf[3.75M]

Book3.pdf[5.57M]

Book4.pdf[5.98M]

Quicksheet.pdf[440.09K]

21年FRM一级教材[93.20M]

1.FoundationsofRiskManagement.pdf

2.QuantitativeAnalysis.pdf[28.77M]

3.FinancialMarketsandProducts.pdf[36.16M]

4.ValuationandRiskModels.pdf[28.27M]

2021年5月or7月选择考试时间及考点指引流程.pdf[375.67K]

21年FRM_StudyGuide.pdf[3.23M]

21年FRM_StudyGuideChanges.pdf[1.02M]

00-21年考纲解读[122.15M]

20201202_FRM一二级考纲解读直播.pdf[2.32M]

2021年FRM考纲解读直播.mp4[119.83M]

01-前导班[1.85G]

01-QuantitativeMethods[567.61M]

01-Introduction.mp4[7.69M]

02-从赌注分配引发的概率问题.mp4[30.53M]

03-从赌徒谬误体会事件的关系.mp4[13.64M]

04-条件概率的介绍.mp4[29.64M]

05-全概率的计算方法.mp4[30.77M]

06-概率分布的介绍.mp4[49.97M]

07-中心趋势指标的差异探析.mp4[31.68M]

08-离散程度指标的介绍.mp4[26.51M]

09-抽样的重要性.mp4[31.14M]

10-样本好坏很重要.mp4[20.44M]

11-抽样偏差的介绍.mp4[12.57M]

12-从点估计到区间估计.mp4[110.45M]

13-证伪容易证明难.mp4[30.60M]

14-小概率事件很难发生.mp4[19.20M]

15-函数关系VS.相关关系.mp4[14.57M]

16-协方差与相关系数.mp4[41.26M]

17-相关关系≠因果关系.mp4[9.55M]

18-回归分析.mp4[22.03M]

19-时间序列的拆解.mp4[35.39M]

02-TheCalculator[305.17M]

01-BasicUseoftheCalculator.mp4[177.36M]

02-AdvancedUseoftheCalculator.mp4[127.81M]

03-FixedIncomeSecurities[413.79M]

01-Introduction.mp4[15.19M]

02-SecuritiesClassification.mp4[18.55M]

03-DefinitionofFixedIncomeSecurities.mp4[39.95M]

04-Bondsvs.Stocks.mp4[51.20M]

05-FiveFactorsofBonds.mp4[51.96M]

06-GovernmentBonds.mp4[17.10M]

07-CorporateBonds.mp4[33.07M]

08-TimeValueofMoney.mp4[18.15M]

09-BasicBondPriceCalculation.mp4[18.92M]

10-EffectsofDiscountRateChange.mp4[14.20M]

11-InterestRateRisk.mp4[39.32M]

12-CreditRisk.mp4[96.20M]

04-Derivatives[354.01M]

01-航空公司和石油生产商所担心的事.mp4[13.73M]

02-风险的含义.mp4[4.09M]

03-衍生品的定义.mp4[34.08M]

04-远期合约.mp4[41.56M]

05-期货合约.mp4[67.25M]

06-互换定义及产生背景.mp4[23.79M]

07-利率互换.mp4[25.72M]

08-期权产生背景及定义.mp4[21.68M]

09-期权收益及利润.mp4[24.60M]

10-期权的风险.mp4[21.83M]

11-2018年中石化衍生品交易.mp4[29.50M]

12-罗伯特·莫顿那些事.mp4[46.19M]

05-公司治理CRO的自我修养[208.98M]

01-HelicopterView:CorporateGovernance.mp4[55.07M]

02-HelicopterView:CorporateGovernance.mp4[84.41M]

03-CorporateBusinessActivities.mp4[31.27M]

04-RiskVs.Return.mp4[38.22M]

FRM前导课_公司治理(CRO的自我修养)图.rar[3.14M]

FRM网课计算器前导.rar[1.19M]

FRM前导数量网课.rar[8.19M]

FRM衍生前导网课图像模式.rar[8.33M]

固收前导网课课件.rar[22.36M]

02-知识精讲[12.06G]

01-定量分析[2.49G]

01-IntroductiontoQuantitativeAnalysis.mp4[22.21M]

1.1BasicConcepts.mp4[54.26M]

1.2RelationshipsbetweenEvents.mp4[75.28M]

1.3BayesRule.mp4[83.39M]

10.1CovarianceStationary.mp4[95.95M]

10.2AR,MAandARMAModels.mp4[92.99M]

10.3Forecasting.mp4[48.12M]

10.4Appendix10.1Invertibility.mp4[13.85M]

10.5Appendix10.2ModelSelection.mp4[20.32M]

11.1TimeTrendsandSeasonality.mp4[61.91M]

11.2RandomWalkandUnitRoot.mp4[41.77M]

11.3Forecasting.mp4[31.25M]

12.1MeasuringReturnsandVolatility.mp4[50.03M]

12.2Correlationvs.Dependence.mp4[34.03M]

13.1MonteCarloSimulation.mp4[107.61M]

13.2Bootstrapping.mp4[35.48M]

2.1DiscreteandContinuousRandomVariables.mp4[63.92M]

2.2TheFourNamedMoments.mp4[92.29M]

2.3QuantilesandModes.mp4[47.00M]

3.1DiscreteRandomVariables.mp4[83.64M]

3.2ContinuousRandomVariables.mp4[119.95M]

3.3MixturesofDistributions.mp4[22.67M]

4.1DiscreteRandomVariables.mp4[73.14M]

4.2Moments.mp4[100.05M]

4.3IidRandomVariables.mp4[26.78M]

4.4Appendix4.1Covariance.mp4[17.76M]

5.1Estimation&Estimator.mp4[105.63M]

5.2MeanEstimator.mp4[60.15M]

5.3MultivariateMomentEstimator.mp4[30.75M]

5.4Appendix5.1VarianceofSampleMean.mp4[18.47M]

5.5Appendix5.2CentralLimitTheorem.mp4[16.45M]

5.6Appendix5.3CalculateSampleCorrelation[Calculator].mp4[8.91M]

6.1SixDistinctComponents.mp4[102.60M]

6.2TypeIvs.TypeIIError.mp4[42.30M]

6.3AlternativeStatistics.mp4[38.39M]

6.4Application.mp4[30.16M]

6.5Appendix6.1DistributionsofT-Statistic.mp4[11.24M]

6.6Appendix6.2p-value.mp4[17.07M]

6.7Appendix6.3One-SidedConfidenceInterval.mp4[8.78M]

7.1ModelConstruction.mp4[51.11M]

7.2OrdinaryLeastsquares.mp4[46.76M]

7.3MeasureofFit&HypothesisTesting.mp4[70.69M]

7.4Appendix7.1ViolationofOLSAssumptions.mp4[30.52M]

7.5Appendix7.2ApplicationCAPM.mp4[17.08M]

8.1ModelConstruction.mp4[24.69M]

8.2MeasuringModelFit.mp4[38.63M]

8.3HypothesisTesting.mp4[40.87M]

8.4Appendix8.1StepwiseEstimation.mp4[17.84M]

9.1TheBias-VarianceTradeoff.mp4[81.23M]

9.2Heteroskedasticity.mp4[29.95M]

9.3Multicollinearity.mp4[28.19M]

9.4Outliers&StrengthofOLS.mp4[32.48M]

FRMEP2_.pdf[35.08M]

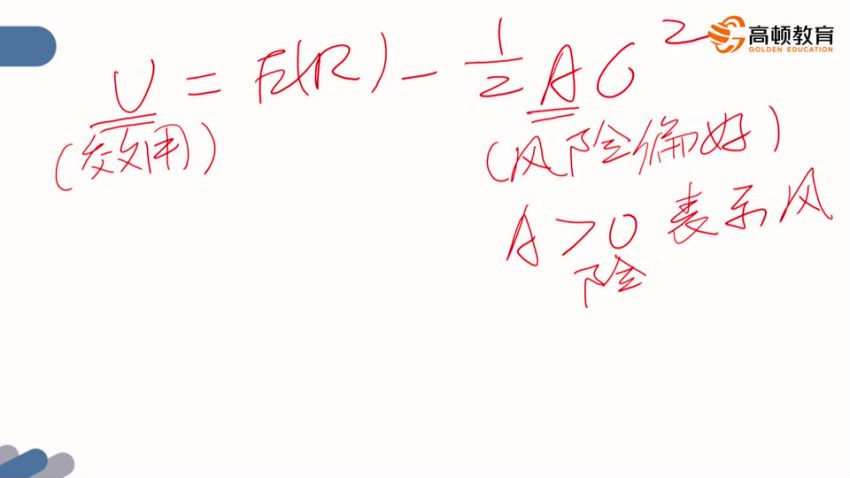

02-风险管理基础[2.31G]

0.0IntroductiontoFoundationsofRiskManagement.mp4[29.92M]

1.1BasicsofRiskManagement.mp4[21.68M]

1.2RiskManagementBuildingBlocks(1).mp4[100.90M]

1.2RiskManagementBuildingBlocks(2).mp4[162.95M]

10.1Thebuild-uptothefinancialcrisis.mp4[136.03M]

10.2Theliquidityandcreditcrunch.mp4[64.49M]

10.3Therolesofinstitutionsandthepolicyresponses.mp4[60.74M]

11.1CodeofConduct.mp4[37.80M]

11.2RulesofConduct.mp4[43.31M]

11.3ApplicabilityandEnforcement.mp4[11.21M]

2.1ProcessofRiskManagement.mp4[94.99M]

2.2ConsandProsofHedging.mp4[34.98M]

3.1CorporateGovernance.mp4[55.04M]

3.2MechanismsofRiskGovenance.mp4[75.38M]

4.1CreditRiskTransferMechanisms.mp4[91.65M]

5.1Modernportfoliotheory.mp4[172.55M]

5.2CapitalAssetPricingTheory.mp4[206.72M]

5.3Performancemeasurement.mp4[73.92M]

6.1ArbitragePricingTheory.mp4[109.38M]

6.2MultifactorModel.mp4[36.91M]

7.1RiskDataAggregation.mp4[39.16M]

7.2RiskReporting(1).mp4[19.33M]

7.2RiskReporting(2).mp4[12.55M]

8.1EnterpriseRiskManagementandFutureTrend.mp4[121.83M]

9.1FinancialDisasters(1).mp4[121.65M]

9.1FinancialDisasters(2).mp4[155.91M]

9.1FinancialDisasters(3).mp4[169.50M]

9.1FinancialDisasters(4).mp4[58.04M]

精讲-风险管理基础–GONG老师.pdf[42.57M]

03-金融市场与产品[3.29G]

01-IntroductiontoFinancialMarketsandProducts.mp4[32.04M]

02-IntroductiontoForwardandFutures.mp4[96.76M]

03-ExchangesandOTCMarkets.mp4[88.98M]

04-FuturesMarket.mp4[104.62M]

05-UsingFuturesforHedging(1).mp4[66.71M]

06-UsingFuturesforHedging(2).mp4[102.53M]

07-PricingFinancialForwardsandFutures.mp4[85.83M]

08-ValuationofFinancialForwardsandFutures.mp4[78.79M]

09-1-Interestrateparitytheorem.mp4[92.64M]

09-ForeignExchangeMarkets.mp4[204.28M]

10-1-ExpectedfuturespotpriceandForwardprice.mp4[47.75M]

10-CommodityForwardsandFutures.mp4[149.11M]

11-IntroductiontoSwaps.mp4[92.47M]

12-SwapCashFlowCalculating.mp4[57.35M]

13-SwapValuation.mp4[86.68M]

14-IntroductiontoOptions.mp4[92.89M]

15-OptionMarket.mp4[72.09M]

16-SixFactors&EarlyExercise.mp4[105.20M]

17-Upper&LowerBoundsofValue.mp4[15.43M]

18-Put-CallParity.mp4[55.57M]

19-OptionTradingStrategies.mp4[149.40M]

20-SpreadTradingStrategies.mp4[99.54M]

21-CombinedStrategies.mp4[16.35M]

22-ExoticOptions.mp4[136.38M]

23-OthertypesofExotics.mp4[40.26M]

24-BinomialTrees.mp4[185.25M]

25-TheBlack-Scholes-MertonModel.mp4[159.27M]

26-Somediscussionsaboutthemodel.mp4[41.99M]

27-TheintroductionoftheGreekletters.mp4[64.13M]

28-DeltaandGammahedging.mp4[83.99M]

29-Vega,ThetaandRho.mp4[73.42M]

30-Banks.mp4[86.68M]

31-LifeInsuranceCompany.mp4[125.58M]

32-OtherInsuranceCompanyandPensionPlan.mp4[70.74M]

33-MutualFunds.mp4[70.25M]

34-HedgeFunds.mp4[91.67M]

35-MechanicsofaCCP.mp4[38.18M]

36-RisksfacedbyaCCP.mp4[103.25M]

FRMP1B3录制课件完整版.pdf[4.52M]

04-估值与风险模型[3.97G]

01-IntroductiontoValuationandRiskModels.mp4[44.75M]

1.1IntroductionofBonds.mp4[104.39M]

1.2bondmarkets(1).mp4[94.67M]

1.2bondmarkets(2).mp4[44.33M]

1.3BondIndenture.mp4[68.23M]

1.4BondRisks.mp4[54.23M]

10.1HistoricalSimulation.mp4[61.70M]

10.2DeltaNormalApproach.mp4[87.00M]

10.3MonteCarloSimulation.mp4[39.03M]

11.1Assetreturndistribution.mp4[27.76M]

11.2Volatilityestimationapproach.mp4[174.77M]

11.3Historicalsimulationwithdifferentweightingschemes.mp4[39.28M]

12.1Externalratings.mp4[76.19M]

12.2Factorsincreditratings.mp4[33.15M]

12.3Internalratings.mp4[39.67M]

13.1Importantfactorsincreditrisk.mp4[78.59M]

13.2ExpectedLossvs.UnexpectedLoss.mp4[83.14M]

13.3Economiccapitalforbankscreditrisk.mp4[193.86M]

14.1Sourcesofcountryrisk.mp4[59.99M]

14.2Sovereigndefaultrisk.mp4[56.20M]

15.1Definitionandcategories.mp4[24.48M]

15.2Measurementandmanagement.mp4[100.81M]

16.1Stresstestingandothertools.mp4[25.15M]

16.2Keyaspectsofeffectivegovernance.mp4[25.33M]

16.3GovernanceandBaselsprinciples.mp4[34.24M]

17.1ConclusionofValuationandRiskModels.mp4[10.70M]

2.1USTreasury.mp4[88.42M]

2.2TheLawofonePrice.mp4[39.94M]

3.1Fundamentals.mp4[96.72M]

3.2SpotRates.mp4[71.38M]

3.3Forwardandparrates.mp4[156.98M]

3.4Othersrates.mp4[77.66M]

3.5Termstructure.mp4[68.45M]

4.1YieldtoMaturity.mp4[141.18M]

4.2Conventionsforquotationandcalculations.mp4[66.78M]

4.3DecompositionOfP&L.mp4[100.44M]

5.1Duration(1).mp4[85.69M]

5.1Duration(2).mp4[89.68M]

5.2Convexity.mp4[105.84M]

5.3Hedging.mp4[47.28M]

6.1PrincipalComponentsAnalysis.mp4[47.68M]

6.2Keyrate01s(1).mp4[59.94M]

6.2Keyrate01s(2).mp4[51.48M]

6.3ForwardBucket01.mp4[60.61M]

7.1MortagageandMortgagePools.mp4[83.15M]

7.2Mortgage-BackedSecurities.mp4[149.92M]

7.3ValuationofMBS.mp4[48.68M]

8.1Forwardrateagreements.mp4[36.93M]

8.2TreasuryBondFutures.mp4[61.51M]

8.3Complementary.mp4[53.91M]

8.4EurodollarFutures.mp4[79.61M]

8.5HedgingStrategies.mp4[42.35M]

9.1ValueofRisk.mp4[114.01M]

9.2ExpectedShortfall.mp4[59.06M]

FRM2021P1B4Introduction.pdf[1.71M]

FRM2021P1B4Session1.pdf[54.20M]

FRM2021P1B4Session2.pdf[55.42M]

FRM2021P1B4Session3.pdf[30.47M]

FRM2021P1B4Session4.pdf[34.74M]

FRM2021P1B4Session5.pdf[19.87M]

03-诺曼底[5.39G]

01-风险管理基础[1.08G]

01-知识点串讲[731.66M]

01-Session1:RiskManagementFramework(1).mp4[147.19M]

Session1:RiskManagementFramework(2).mp4[139.61M]

Session2PortfolioManagement-ModernPortfolioTheoryandCapitalAssetPricingModel(1).mp4[67.63M]

Session2PortfolioManagement-ModernPortfolioTheoryandCapitalAssetPricingModel(2).mp4[79.81M]

Session2PortfolioManagement-ModernPortfolioTheoryandCapitalAssetPricingModel(3).mp4[31.08M]

Session2TheArbitragePricingTheoryandMultifactorModelsofRiskandReturn.mp4[28.18M]

Session3RiskManagementFailures-AnatomyofTheGreatFinancialCrisisof2007-2009.mp4[67.19M]

Session3RiskManagementFailures-LearningfromFinancialDisasters.mp4[153.90M]

Session4GARPCodeofConduct.mp4[17.06M]

02-强化题解析[368.31M]

1-强化题解析1-10题.mp4[68.26M]

2-强化题解析11-20题.mp4[76.79M]

3-强化题解析21-30题.mp4[48.69M]

4-强化题解析31-40题.mp4[47.91M]

5-强化题解析41-50题.mp4[56.18M]

6-强化题解析51-60题.mp4[50.77M]

7-强化题解析61-65题.mp4[19.70M]

FRM网课_P1B1_复习课.pdf[0.99M]

02-定量分析[1.06G]

01-知识点串讲[829.32M]

01-课程介绍.mp4[11.68M]

02-Session1Probabilities-FundamentalsofProbability.mp4[75.61M]

03-Session2Statistics-RandomVariables.mp4[60.80M]

04-Session2Statistics-CommonUnivariateRandomVariables.mp4[80.44M]

05-Session2Statistics-MultivariateRandomVariables.mp4[62.61M]

06-Session2Statistics-Samplemoments.mp4[39.76M]

07-Session2Statistics-Hypothesistesting.mp4[63.49M]

08-Session3Econometrics-Linearregression.mp4[48.49M]

09-Session3Econometrics-Regressionwithmultipleexplanatoryvariables.mp4[64.26M]

10-Session3Econometrics-RegressionDiagnosis.mp4[82.06M]

11-Session4TimeSeries-StationaryTimeSeries.mp4[114.25M]

12-Session4TimeSeries-Non-stationaryTimeSeries.mp4[58.46M]

13-Session4TimeSeries-MeasuringReturns,Volatility,andCorrelation.mp4[30.35M]

14-Session5Simulation-SimulationandBootstrapping.mp4[37.05M]

02-强化题解析[219.02M]

01-强化题(1)上.mp4[56.82M]

02-强化题(1)下.mp4[35.09M]

03-强化题(2)上.mp4[35.88M]

04-强化题(2)下.mp4[26.06M]

05-强化题(3)上.mp4[24.05M]

06-强化题(3)中.mp4[26.46M]

07-强化题(3)下.mp4[14.65M]

诺曼底-FRMP1B2复习课.pdf[36.85M]

03-金融市场与产品[1.71G]

01-知识点串讲[1.31G]

01-1ForwardandFutures-Introductionofforwardandfutures.mp4[35.35M]

01-Overview.mp4[12.80M]

03-1ForwardandFutures-ExchangeandOTCMarkets.mp4[43.47M]

04-Session1ForwardandFutures-FuturesMarkets.mp4[64.86M]

05-Session1ForwardandFutures-UsingFuturesforHedging.mp4[112.79M]

06-Session1ForwardandFutures-PricingFinancialForwardsandFutures.mp4[67.12M]

07-Session1ForwardandFutures-ForegignExchangeMarkets.mp4[82.34M]

08-Session1ForwardandFutures-CommodityForwardsandFutures.mp4[83.71M]

09-Session2Swaps.mp4[53.82M]

10-Session3Options-IntroductiontoOptions.mp4[32.73M]

11-Session3Options-OptionMarkets.mp4[27.31M]

12-Session3Options-PropertiesofOptions.mp4[123.24M]

13-Session3Options-TradingStrategies.mp4[72.63M]

14-Session3Options-ExoticOptions.mp4[72.88M]

15-Session3Options-BinomialTrees.mp4[67.29M]

16-Session3Options-TheBlack-Scholes-MertonModel.mp4[75.75M]

17-Session3Options-TheGreekLetters.mp4[87.04M]

18-Session4FinancialInstitutions-Banks.mp4[37.46M]

19-Session4FinancialInstitutions-InsuranceCompaniesandPensionPlans.mp4[83.37M]

20-Session4FinancialInstitutions-MutualFundsandHedgeFunds.mp4[59.37M]

21-Session4FinancialInstitutions-CentralCounterparties.mp4[44.00M]

02-强化题解析[403.47M]

01-强化题(1)上.mp4[53.44M]

02-强化题(1)下.mp4[62.10M]

03-强化题(2)上.mp4[77.39M]

04-强化题(2)下.mp4[71.79M]

05-强化题(3)上.mp4[67.41M]

06-强化题(3)中.mp4[43.43M]

07-强化题(3)下.mp4[27.91M]

诺曼底-FRMP1B3复习课.zip[3.88M]

04-估值与风险模型[1.55G]

01-知识点串讲[1.28G]

01-Introduction.mp4[51.20M]

02-Session1FixedIncomeSecurities(Valuation)-CorporateBonds.mp4[87.36M]

03-Session1FixedIncomeSecurities(Valuation)-PricingConbentions.mp4[29.34M]

04-Session1FixedIncomeSecurities(Valuation)-Interestrates(1).mp4[76.69M]

05-Session1FixedIncomeSecurities(Valuation)-Interestrates(2).mp4[94.10M]

06-Session1FixedIncomeSecurities(Valuation)-BondYieldsandReturn.mp4[97.16M]

07-Session2FixedIncomeSecurities(RiskManagement)-Duration.mp4[138.12M]

08-Session2ModellingNon-ParallelTermStructureShiftsandHedging.mp4[49.63M]

09-Session2FixedIncomeSecurities(RiskManagement)-Mortgages.mp4[118.15M]

10-Session2FixedIncomeSecurities(RiskManagement)-InterestRate.mp4[85.54M]

11-Session3MarketRisk-MeasuresofFinancialRisk.mp4[55.34M]

12-Session3MarketRisk-CalculatingandApplyingVaR.mp4[90.03M]

13-Session3MarketRisk-MeasuringandMonitoringVolatility.mp4[68.54M]

14-Session4CreditRisk-ExternalandInternalRatings.mp4[36.60M]

15-Session4CreditRisk-MeasuringCreditRisk.mp4[96.32M]

16-Session4CreditRisk-CountryRisk.mp4[43.71M]

17-Session5OperationalRisk.mp4[42.71M]

18-Session5StressTesting.mp4[22.24M]

19-课程总结.mp4[27.38M]

02-强化题解析[234.14M]

01-强化题(1)上.mp4[44.03M]

02-强化题(1)下.mp4[40.70M]

03-强化题(2)上.mp4[31.23M]

04-强化题(2)下.mp4[38.67M]

05-强化题(3)上.mp4[28.21M]

06-强化题(3)中.mp4[32.79M]

07-强化题(3)下.mp4[18.52M]

诺曼底-FRMP1B4复习课.zip[39.93M]

04-冲刺阶段-思维导图[2.41G]

00-开班直播[117.38M]

复习冲刺开班直播.mp4[110.22M]

复习冲刺开班直播-讲义.pdf[7.16M]

01-定量分析[562.99M]

定量分析-思维导图.pdf[27.30M]

思维导图-定量分析上.mp4[401.96M]

思维导图-定量分析下.mp4[133.73M]

02-风险管理基础[559.22M]

思维导图-风险管理基础.pdf[32.51M]

思维导图-风险管理基础上.mp4[244.71M]

思维导图-风险管理基础下.mp4[282.00M]

03-金融市场与产品[763.18M]

金融市场与产品-思维导图.pdf[92.86M]

思维导图-金融市场与产品上.mp4[286.85M]

思维导图-金融市场与产品下.mp4[383.47M]

04-估值与风险模型[468.86M]

思维导图-估值与风险模型.pdf[45.65M]

思维导图-估值与风险模型上.mp4[235.82M]

思维导图-估值与风险模型下.mp4[187.39M]

05-冲刺阶段-65题重难点回顾[911.46M]

65题重难点回顾-定量分析.mp4[217.66M]

65题重难点回顾-定量分析讲义.pdf[6.22M]

65题重难点回顾-风险管理基础.mp4[177.35M]

65题重难点回顾-风险管理基础讲义.pdf[23.30M]

65题重难点回顾-估值与风险模型.mp4[193.10M]

65题重难点回顾-估值与风险模型讲义.pdf[8.38M]

65题重难点回顾-金融市场与产品.mp4[280.13M]

65题重难点回顾-金融市场与产品讲义.pdf[5.30M]

06-模考班[917.37M]

讲义[53.25M]

practiceexam–P1B1答疑直播讲义.pdf[9.59M]

practiceexam–P1B2答疑直播讲.pdf[10.73M]

practiceexam–P1B3答疑直播讲义.pdf[13.66M]

practiceexam–P1B4答疑直播讲义.pdf[19.27M]

practiceexam–P1B1答疑直播.mp4[174.13M]

practiceexam–P1B2答疑直播.mp4[194.02M]

practiceexam–P1B3答疑直播.mp4[268.44M]

practiceexam–P1B4答疑直播.mp4[227.53M]

07-押题班[1.62G]

MOCK-A[991.49M]

MOCK-A定量分析.mp4[203.39M]

MOCK-A定量分析讲义.pdf[10.02M]

MOCK-A风险管理基础讲义.pdf[18.11M]

MOCK-A估值与风险模型.mp4[271.44M]

MOCK-A估值与风险模型讲义.pdf[15.15M]

MOCK-A金融市场与产品.mp4[309.57M]

MOCK-A金融市场与产品讲义.pdf[1.62M]

MOCK-A押题密卷风险管理基础.mp4[162.19M]

MOCK-B[667.21M]

MOCK-B定量分析.mp4[227.74M]

MOCK-B定量分析讲义.pdf[10.56M]

MOCK-B风险管理基础.mp4[168.92M]

MOCK-B风险管理基础讲义.pdf[3.05M]

MOCK-B金融市场与产品.mp4[246.04M]

MOCK-B金融市场与产品讲义.pdf[10.90M]

网盘下载:

如下载链接失效,请在页面底部评论,24小时内修复下载链接。

评论0